Report: 24th ASEAN Energy Business Forum (AEBF-24)

Authored By: Brian McFeeters, Senior VP and Regional Managing Director, USABC

In Collaboration With: USABC Member Companies & U.S. Govt. Participants in AEBF-24

Edited By: Logan Carnicelli and Chau Dang

Overview

The September 25-27 ASEAN Energy Business Forum (AEBF) in Vientiane, painted a challenging energy transition picture. Energy demand across ASEAN is projected to grow by 60% by 2040 and to double by 2050, as reported by the AEBF Knowledge Partner, Boston Consulting Group (BCG). Additionally, approximately 3.5 million people, or about 5% of the population, still lack access to electricity. A key theme of the conference was the region's heavy dependence on coal without a viable exit path.

The conference was held concurrently with the ASEAN Energy Ministers Meeting, attracting about 1,400 participants. While ministers and their delegations attended briefly, greater interaction between them and the conference attendees would have enhanced the experience.

The ASEAN Center for Energy (ACE) organizers (Acting Executive Director Beni Suryadi and Deputy Andy Tirta leading the team) and part of the ASEAN Secretariat ensured there were multiple approaches to key topics – the ASEAN Power Grid, Renewable Energy potential, EVs, financing approaches, and others -- backed by recent data and documents. As Deputy Director General of the International Renewable Energy Association (IRENA) Gauri Singh said, these documents and data are important “to bring countries together,” given how diverse ASEAN member states are in terms of energy production and use.

This report includes possible energy-transition business opportunities for USABC member companies, based on AEBF discussions of ASEAN member states’ plans.

Coal

Many panelists at the AEBF agreed that ASEAN is, and will remain, dependent on fossil fuels. Coal accounted for 42% of electricity generation in 2022. An ASEAN coal plan released this May sees coal remaining close to its current level until 2030 and then declining to 28% of electricity generation by 2050. A senior Petronas (Malaysia National Petroleum Company) executive said, “Coal won’t stop by 2050” and will remain “part of our core business.” Notably, there was little discussion regarding the outright retirement of existing coal plants or the cancellation of planned coal plant construction.

In a panel on decarbonization, a PLN (Indonesia Electric Company) official said that planned coal plant retirements had been shelved for now. Instead, a speaker from the Japanese Organization for Metals and Energy Security (JOGMEC) said coal plants could be retrofitted to burn ammonia or hydrogen or could have carbon-capture-storage (CCS) facilities included.

As an aside, the JOGMEC speaker noted it is difficult to get financing for any coal-related project, even if aimed at emission abatement. In another session on CCS, President of the Japan Carbon Frontier Organization Tsukamoto Osamu shared that his organization anticipates capturing CO2 in Japan and South Korea, which will then be transported to the ASEAN region for storage. His organization is carrying out a 2021-2025 full demonstration project with Japan’s Ministry of Environment.

While AEBF did not provide details on ASEAN member states’ plans to retrofit existing coal power plants or install CCS equipment, there was a strong sense that officials aspire to do so in what seems to be the absence of viable coal-plant retirement plans. USABC and relevant member companies should engage in discussions with officials from Indonesia and Vietnam—both of which have internationally backed coal-plant retirement plans—as well as other ASEAN nations, to explore potential options for collaboration and advancement in this area.

Furthermore, there is increasing interest in CC(U)S, supporting the planned USABC special project to discuss and explain CCS with senior government officials in several ASEAN member states including Malaysia and Indonesia.

Gas

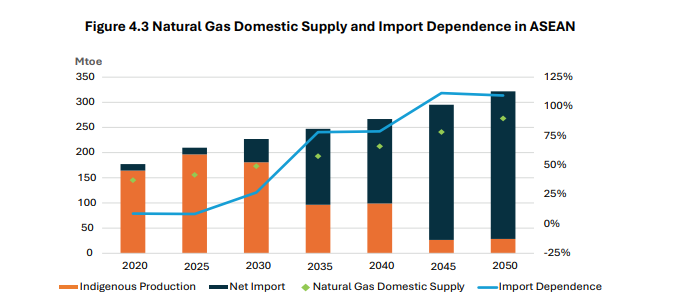

Several sessions discussed that gas demand will continue to grow in ASEAN’s energy market as a substitute for coal.

This trend is particularly relevant for U.S. suppliers, as imported gas demand increased from 14% of total gas used in 2005 to 22% in 2020. The 8th ASEAN Energy Outlook projects that trend will continue, presenting opportunities for USABC member companies.

ASEAN Power Grid

After coal, the AEBF’s second most prominent theme was the ASEAN Power Grid – one of seven key priorities in ASEAN’s guiding strategy document, the “ASEAN Plan of Action for Energy Cooperation” (APAEC), now undergoing revision to cover 2025-2035. The other priorities are trans-ASEAN gas pipelines, coal and clean coal technology, energy efficiency and conservation, renewable energy, regional energy and policy planning, and civilian nuclear energy. Discussed since 2009, the ASEAN Power Grid (APG) calls for 18 interconnections between ASEAN member states, 9 of which have been completed. However, progress in recent years has generally been viewed as slow. The most significant recent achievement was the mid-2022 Laos-Thailand-Malaysia-Singapore (LTMS) connection, which currently delivers 100 MW to Singapore and is expected to increase to 300 MW by 2025.

Many speakers touted the benefits of the APG. “There is no transition without transmission,” said Razib Dawood, CEO of Malaysia’s Energy Commission. A representative of the Japan International Cooperation Agency (JICA) said the APG would help balance the “mal-distribution of renewable energy potential” across ASEAN. Completed, it would lower marginal power needs (extra electrical capacity in case of surging demand) from an average of 7% in all ASEAN member states to close to zero, he added. BCG speakers said that a completed APG would lead to 8-10% lower electricity costs ASEAN-wide. BCG estimated that $300 billion is needed in the short term to complete the APG, with a total of $700 billion required over the longer term. Speakers lamented that APG progress has been slow, stressing financing difficulties for cross-border projects and a lack of common technical standards.

The U.S. Government, represented at AEBF by U.S. Agency for International Development Assistant (USAID) Administrator for Asia Michael Schiffer, had a prominent role at the conference, with tangible support for the APG. Schiffer explained that USAID had sponsored a June 2024 detailed update to the APG masterplan, and together with the U.S. Trade and Development Agency arranged for a feasibility study on connecting Indonesia’s and Malaysia’s power grids in two places – Kalimantan to Sarawak, and Sumatra to Peninsular Malaysia. The latter would be the first APG project including an undersea cable.

A USABC member company, Delphos, is the lead grantee carrying out that feasibility study, and the terms include seeking out export and other business opportunities for U.Ss firms.

Another USABC connection to USAID's energy transition program is through member company Deloitte, which serves as the implementer for USAID's Southeast Asia Smart Program, aimed at improving access to clean energy.

Ambassador McFeeters met with Schiffer and USAID colleagues on the sidelines of the conference, agreeing that USABC, USAID, and USTDA (though not present) have scope for substantial cooperation including on emerging business opportunities related to the APG and other areas. USABC will follow up and provide more information.

Renewable Energy

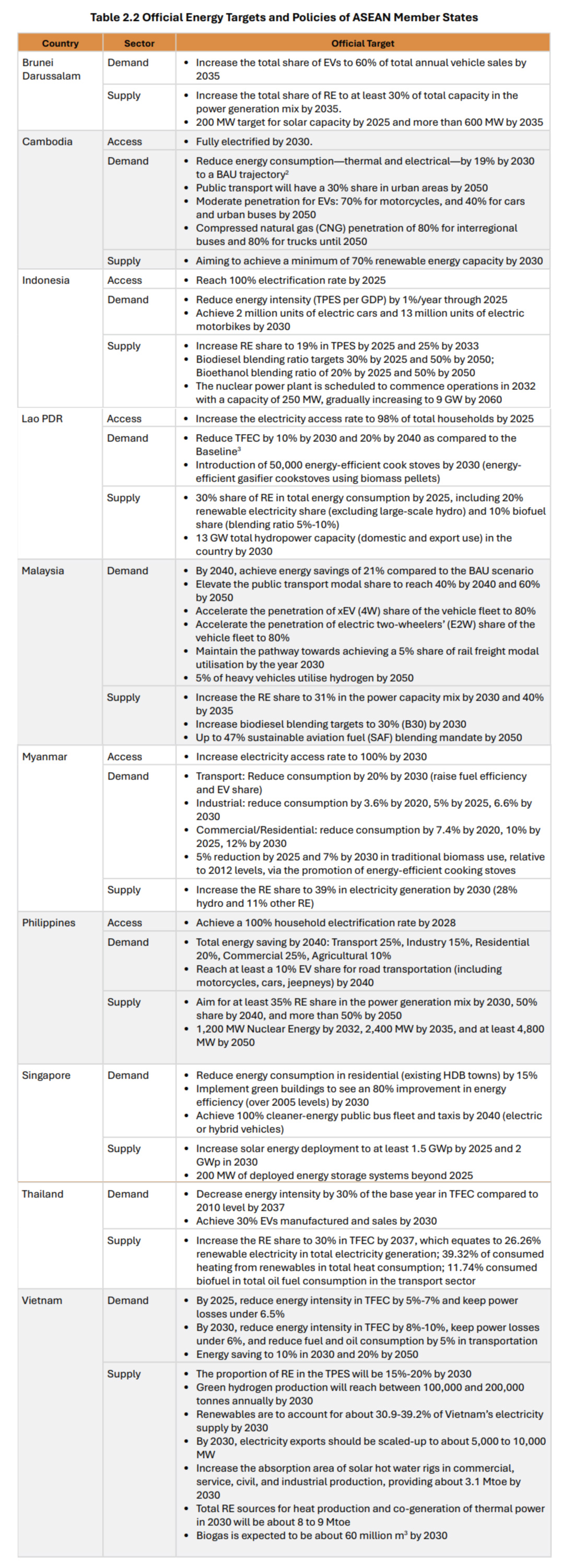

ASEAN’s energy transition seems to have considerable potential to speed up. ACE officials and other speakers were glad to report that Renewable Energy as a share of total energy reached 29% in 2022 (20% hydro, 3% biomass, 3% solar, 2% geothermal, and 1% wind) ASEAN-wide. ACE officials believe this level is roughly on track to meet ASEAN's target of 35% renewable energy by 2025. For a summary of each ASEAN member state’s renewable energy plans, see Table 2.2 below.

Hydropower

The most extensive renewable energy discussions were on hydro, led by conference host and hydropower leader Laos (which produces about 10 GW during rainy season and exports 6.3 GW of that). The CEO of Sarawak Energy (the east Malaysian state that is vying with Laos to be the leading hydropower producer) touted the dams already producing electricity in Sarawak -- Batang Ai (94 MW), Bakun (2520), Murum (944) – and added that a new one slated for 2030 completion, called Baleh, would produce 2,520 MW. The Sarawak Energy CEO called for ASEAN to reach 1,100 GW of hydropower by 2050, but noted it was only 5% of the way there.

Sarawak Energy has announced that USABC member company GE Vernova is the consortium leader on the powerhouse package, which includes Sinohydro as the civil works provider and GE Hydro (part of GE Vernova) as the equipment supplier.

Other renewable energy sources were discussed, particularly solar energy—including large-scale, floating, and rooftop installations—as a promising growth area in various sessions. However, there were no in-depth discussions on solar energy this year.

Nuclear

Nuclear energy also was not a major subject of discussion. A representative of the Economic Research Institute of ASEAN (ERIA, largely Japan-supported) said it made sense for ASEAN member states to consider small modular reactors. An official from ACE noted that the 8th ASEAN Energy Outlook characterizes Indonesia as having “nuclear ambitions” to the tune of 9 GW by 2060; the Philippines is “considering” 4.8 GW by 2050; and Singapore, Thailand and Vietnam are also discussing nuclear power options. On the sidelines of the conference, a Malaysian official said her government is also exploring nuclear power plans.

The 8th ASEAN Energy Outlook notes that USTDA funded a nuclear feasibility study in Indonesia in 2023; further opportunities for such feasibility studies may be available.

Transportation/EVs

Graphion Energy Solutions, an EV-motorcycle retrofitting company headquartered in the U.S. with an ambitious launch project in Laos, was a leading sponsor of the AEBF. CEO Ki Nam promoted a low-cost (about $300 to retrofit most motorcycles), fast-charging (10 minutes with high power, 20 minutes with a conventional charger) solution for what he said were ASEAN’s 250 million motorcycles, much worse polluters than cars. The company intends to put 1 million motorcycles on Laos (population 7 million) roads within one year. Nam said he is next targeting Indonesia, where he would like to start by installing a network of fast charges in one target city; also interested in Malaysia. He suggested that ASEAN governments could require motorcycles that are over 10 years old (worst polluters) to be either retrofitted as EVs or retired.

More generally, speakers recognized that EV penetration in ASEAN is very low. A representative of Malaysia’s Zero Emission Vehicle Association said EV penetration in her country was only a few hundred in 2021 but would reach 38,000 by the end of 2024. If chargers are built – a slow process with multiple ministries and agencies involved in granting permits – Malaysia could move toward its ambitious goal of 80% EVs by 2050.

While not a direct business opportunity, USABC companies interested in deploying EVs in their fleets may find it worthwhile to press Malaysia and perhaps other ASEAN member states on accelerating charging infrastructure development. One target of opportunity is the November 2024 Transportation Ministers Meeting in Kuala Lumpur.

Assessment and Next Steps

Overall, ACE is considering the data, reporting, and consultation aspects of the energy transition with great attention, producing professional reports and setting up worthwhile discussions, bringing best practices from other international organizations. In contrast, the picture is mixed among ASEAN member states. In discussions surrounding renewable energy, carbon capture and storage (CCS), electric vehicles (EVs), and other related topics, it would have been beneficial to hear officials and speakers outline specific next steps for the next 12 to 24 months, but there was little specificity. The issue of difficulty getting financing, with the private sector not providing enough, was a recurring topic. However, it would have been beneficial to hear descriptions of specific, bankable projects that were ready to proceed, pending only the financing package, as the discussions tended to be more general. Despite this, significant business opportunities exist for USABC member companies in energy, decarbonization, grid upgrades, digitization, and efficiency, as ASEAN member states embark on their energy transition journey. Nonetheless, considerable legwork and discussion will be required to surface these opportunities, one member state at a time.

One specific idea is for a delegation of USABC member companies to participate in and speak about how they be part of ASEAN’s energy transition at the 2025 ASEAN Energy Business Forum to be held in Kuala Lumpur in connection with the Energy Ministers Meeting (date TBD).

Excerpt from 8th ASEAN Energy Outlook, 2024