Malaysia's National Semiconductor Task Force

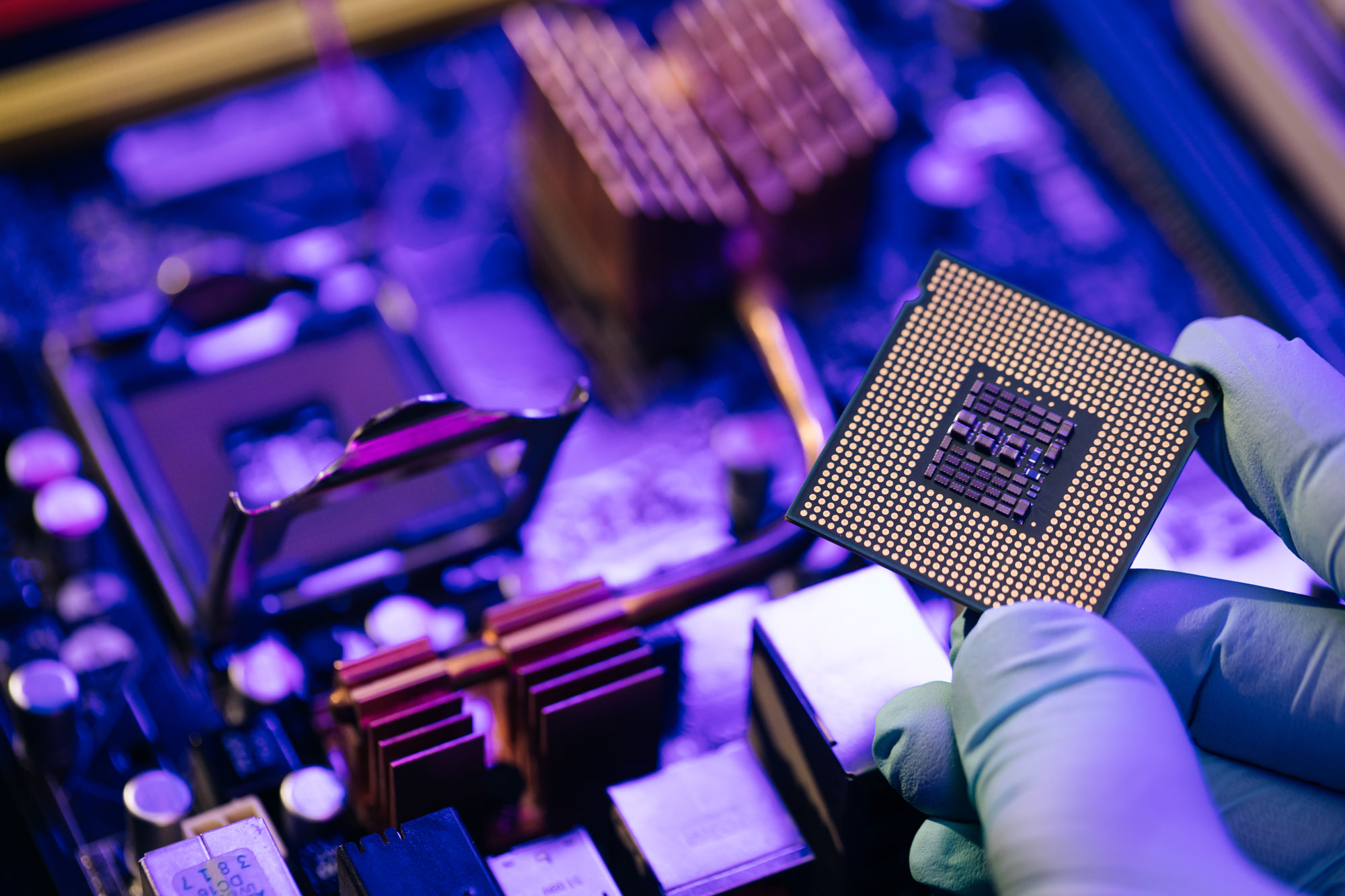

Malaysia’s newly established national semiconductor task force, represents the country’s latest efforts to elevate its chip industry from back-end assembly to front-end manufacturing. The semiconductor supply chain back-end consists of assembly, packing, and testing (APT). Malaysia commands 13% of the world’s APT services but it only accounted for 6% of the industry’s total value added in 2019. In contrast, front-end manufacturing absorbed 25% - the value that the task force wants to capture.

The good news is that Malaysia already has a mature chip cluster. Major chipmakers operating in the country since the 1970 have transformed Malaysia into a semiconductor hub, holding 7% of the global market share and contributing to 23% of U.S. semiconductor trade in 2022.

With a Strong FDI Inflow, Chip industry Climbing Up the Value Chain

The recent U.S. restrictions to block China’s chip access are reshaping China’s domination of the APT services, which commands 38% of the global market share. Major chipmakers have begun to diversifytheir productions and Malaysia’s mature semiconductor ecosystem makes it a prime destination. In addition to packaging firms, Malaysia’s chip cluster is welcoming investments from another group of semiconductor firms: substrate makers, the materials that chips are built on. Only a few companies can produce this chemical, and even fewer make advanced substrates for high-computing chips.

Through the Semiconductor Task Force, Malaysia can leverage its growing strength in the chip supply chain’s back-end stage to attract front-end manufacturing investments. Given its well-established APT cluster, Malaysia can make a strong pitch to chipmakers in terms of supply chain resilience. For instance, the semiconductor task force can highlight that chips produced in Malaysian facilities can be delivered to an APT firm by land rather than sea. That proximity will lower chipmakers’ exposure to extreme supply chain disruptions, such as a Chinese blockade of the Taiwan Strait.

The Minister of Investment, Trade and Industry (MITI) Tengku Zafrul Abdul Aziz’s plan to court electric vehicle (EV) manufacturing can further incentivize chipmakers’ investments in Malaysia. The growing trend of EVs will go hand-in-hand with the rising demand for car chips. Projection shows that the overall revenues for auto chips could rise from $41 billion in 2019 to $147 billion by 2030 and the value of auto chips in vehicles is estimated to go up from its 2020 level of $500 per car to $1,400 by 2028. In fact, the automotive semiconductor market already witnessed a 28% year-over-year growth in 2022, reaching $69 billion. Chip production and EV manufacturing investments are mutually reinforcing. The Task Force can leverage this virtuous cycle to propel the country’s climb up the value chain.

Labor Shortages Remain a Challenge

Nevertheless, the main challenge for that climb will lie in human capital. Malaysia is facing a labor shortage of around 1.2 million workers, including 600,000 in manufacturing. Because of that, some chipmakers in Malaysia have already turned down sales. But as a senior Malaysian official pointed out, the country has sufficient talent. In reality, the root problem is low salaries. The average salary in Malaysia’s manufacturing was $469 per month in 2021, compared to $1,495 in Singapore. That disparity has caused a sustained outflow of Malaysian talent. Worse, chronic low pay continues to discourageMalaysian students from pursuing education in the fields of science, technology, engineering, and mathematics (STEM). For example, Malaysia’s engineer-to-population ratio stood at 1:170 in late 2022, whereas the average rate in developed countries stands around 1:100.

In response, Malaysia’s New Industrial Master Plan 2030 aims to double the manufacturing median wage by 2030. At the same time, the Malaysian government has recently funded the Penang GBS Industry Academy to strengthen cooperation between universities and the industry in expanding the country’s technical talent reservoir.

Strengthening U.S.-Malaysia Semiconductor Cooperation

The Memorandum of Cooperation (MOC) strengthen resiliency in the chip supply chain signed in May 2022 by MITI and the U.S. Commerce Department testified to Malaysia’s significance as America’s third-largest source of chip imports in 2021. U.S.-Malaysia cooperation will be a crucial element in creating secure and sustainable semiconductor supply chains. The task force can contribute to that growing partnership in two main ways. Externally, it can provide insight into regulatory developments in Washington and framing Malaysia as a reliable ally. Internally, it can integrate key resources for chip production, including water, electricity, and above all human capital.

However, as of now, the Semiconductor Task Force, which reports to the National Investment Council(NIC) chaired by the Prime Minister, has not involved foreign businesses. Collaborating with foreign entities would not only bolster NIC’s knowledge base and resources but also advance Malaysia's aspiration to increase foreign investment in this sector. Indeed, including the U.S. private sector will provide invaluable insights for Malaysia to emerge as a frontrunner in the global semiconductor supply chain and bring Silicon Valley of the East back in the game.